Holiday Home Finance Ireland

Mortgages in Ireland

If you're interested in buying a house in Ireland and need a mortgage, our comprehensive guide is a good place to start.

No impact on credit score

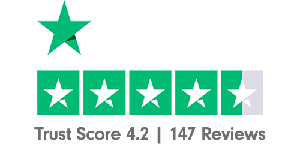

4.8 out of 5 stars across Trustpilot, Feefo and Google! Our customers love Online Mortgage Advisor

Ireland didn't get its name, The Emerald Isle, for nothing. If you're interested in getting closer to the rolling hills and green vales and are after information about getting a mortgage to buy in Ireland, read on for some comprehensive mortgage guidelines, and a few of the things you should look out for, before committing your hard-earned money.

What are you looking for?

How easy is it for a non-resident to get a mortgage in Ireland?

Buying property in Ireland if you're living abroad has never been particularly easy, and with the introduction of new lending restrictions, things haven't exactly improved.

Many banks won't even consider lending to borrowers who don't earn their income in euro.

While you'll definitely find it easier to secure a mortgage if you live in a euro-zone country, some banks will still consider you for a mortgage if you're a foreigner looking for to buy in Ireland.

While the restrictions might make things more awkward, you can make things a little less complicated, and save a lot of time and hassle, by speaking directly to a mortgage advisor with specialist expertise in mortgages in Ireland.

Call 0808 189 2301 for free, no-obligation advice or make a quick online enquiry.

Can I get a UK mortgage to buy in Ireland?

Finding a UK lender that will offer you finance for a property in the Republic of Ireland can be difficult and options are likely to be limited. One workaround solution would be to find an Irish lender with a strong presence in the UK. They will likely deal with th two markets and have knowledge of both.

A mortgage broker with expertise of mortgages in both the UK and Ireland will be able to help you assess which route might be best for you and your own particular circumstances. Also, with access to both UK and Irish mortgage lenders, the options available might mean you find an even better deal on your mortgage too.

Did you know… An Online Mortgage Advisor broker has access to more deals than any comparison site. Get Started to unlock more options and increase your chance of mortgage approval.

Speak to a mortgages in Ireland expert

Mortgages in Ireland: The rules and how they work

With a goal of safeguarding financial stability and helping to build long-term resilience into the financial system, the Irish Central Bank has strict rules on how much people can borrow through a series of mortgage measures.

These measures were first introduced in 2015 and, while they're reviewed on an annual basis, they are made to try to make sure banks and lenders behave sensibly when it comes to lending to borrowers.

The measures also help to prevent property buyers from borrowing beyond their means and therefore prevent excess credit affecting the Irish financial system.

With this in mind, we've broken down everything you should expect when you're considering applying for a mortgage to buy property in Ireland…

How much can I borrow for a mortgage in Ireland?

As part of the measures to protect the Irish economy, borrowers are only allowed to borrow 3.5 times their gross income. This loan-to-income restriction applies to couples looking for a joint mortgage as well as individual borrowers.

However, lenders do have some freedom to make some exceptions to this strict rule. In any single twelve-month period, they are allowed to grant an exception to:

- A maximum of 20% of the value of mortgages to first-time buyers.

- A maximum of 10% of the value of mortgages to second-time buyers

- A maximum of 10% of the values of mortgages to buy-to-let buyers

This rule isn't exceptional to Ireland. There are many other EU territories with similar safeguards in place to protect their country's economy.

How much deposit is required for a mortgage in Ireland?

As well as the loan-to-income limits, Ireland also has measures to protect loan-to-value (LTV) limits which apply to mortgage deposits.

The Irish LTV limits require that you must meet the minimum deposit requirement before you can apply for a mortgage.

How much deposit you need depends on the kind of buyer you are:

- First-time buyers – minimum 10% deposit

- Second time/subsequent buyers – minimum 20% deposit

- Buy-to-let investors – minimum 30% deposit

Again, banks and mortgage lenders have some freedom to apply some exceptions to these rules but if you were a non-resident applying for a mortgage, it's fairly unlikely you would be able to benefit from these.

As a foreign buyer, you may find mortgage lenders require a far bigger deposit. Most providers will ask for at least 30% deposit.

What's a 'stress test' and will it affect me?

As a borrower looking for a mortgage to buy property in Ireland, most lenders will require you to take a 'mortgage stress test'. Any stress test is designed to look at your income and spending habits to ensure you're someone who is financially responsible and able to afford the mortgage you're applying for.

As part of the stress test, most mortgage lenders will ask for up to 12 months of bank statements in order to fully assess your ability to repay any outstanding debt and how your mortgage repayments might affect your financial picture.

Every bank and lender will require you to have a certain level of disposable income, although lenders will vary on how much disposable income is adequate. It's in your interest, as well as your lender's, to ensure you're not over-stretching your finances to meet the mortgage payments.

Life Insurance

In Ireland, it's a requirement to have life cover to protect the mortgage. There are however a handful of instances where this rule may not apply, for example…

- If you can demonstrate that you have been declined and/or cannot obtain life insurance.

- If you can demonstrate that you can obtain insurance but for whatever reason (i.e. medical disclosures) the premium would be exceptionally high.

- The property will not be your main residence.

Help to Buy

If you're purchasing a new build, and you're a first-time buyer, the Help to Buy scheme may be of use to you.

You may be able to get a refund on the income tax that you paid in Ireland over the last few years, which you can put towards your mortgage deposit.

You may also be able to put down a reduced deposit.

While this could help you buy sooner, it can also result in you having to pay more over time.

You can read more about the Irish version of Help to Buy on the Irish Tax and Customs website or call 0808 189 2301 and speak to one of the expert mortgage brokers we work with.

As well as letting you know how you might be able to benefit from the Help to Buy scheme, they can answer any other questions you might have and give you an idea of how to go about getting a mortgage for a property in Ireland from abroad.

Did you know… An Online Mortgage Advisor broker has access to more deals than any comparison site. Get Started to unlock more options and increase your chance of mortgage approval.

Rated Excellent by our customers

What different types of mortgages are available?

Ireland has a well developed mortgage market which means you'll find a range of different mortgage products available.

As you may have gathered from above, decisions about whether you're eligible for a mortgage are pretty stringent and made pretty conservatively. Any bank you approach will ask for strong evidence that you'll be able to meet your mortgage repayments well into the future, even if faced with sudden interest rate hikes.

The main decision you would need to make when choosing the kind of mortgage to get is whether you want a fixed or variable rate product.

- Fixed rate mortgages – Guarantee the same rate over a set period of time, usually 2, 3, 5 or 10 years. However, the downside of this guaranteed stability is that the fixed rate is often higher than rates available at a variable rate.

- Variable rate mortgages – The cost of these mortgages fluctuates with the interest rate changes. These rates typically rise and fall in line with rates from the Central Bank of Ireland. While some products match the chosen rate exactly, some are slightly higher and others offer a discount. However, even if you find a good discounted mortgage, the competitive low rate is usually only available for a limited period before reverting to the SVR.

Naturally, there are various different products aimed at specific buyers, for example. first-time buyers or buy-to-let investors.

Here are just a few of the different types of mortgages available in Ireland:

- Cashback mortgages – As the name suggests, a cashback mortgage rewards you with a cash incentive for taking out a mortgage. Different lenders offer different cashback amounts and incentives, so it's worth using a whole-of-market broker to make sure you're getting the best cash back offer for you.

- Flexible mortgages – Flexible mortgages from lenders in Ireland have various different features for borrowers. These features will vary depending on the lender so you need to shop around to find the flexibility you might most benefit from.

- Reverse mortgages – A form of equity release that allow you to unlock an amount of money using the value in your property. There is no pre-agreed term and the capital you borrow, and all the interest accrued, will be repaid on your death.

- Guarantor mortgages – Can help you purchase a home if you have no deposit or you have a poor credit history could be off-putting to potential lenders. Many lenders offer guarantor mortgages in Ireland.

Talk to an expert broker about which mortgage type might suit you. Whether you're considering a mortgage in Ireland, or elsewhere in the world, the brokers we work with are whole-of-market and have experience of arranging mortgages for people in all kinds of circumstances and around the world.

Make an enquiry and we'll match you with a broker with the right experience to help you meet all your mortgage goals.

How to get a mortgage in Ireland

Let's look at how to get a mortgage for a house in Ireland.

While the process isn't particularly complicated, it can be long and if you're living outside Ireland when you're trying to buy in Ireland, things may not be quite so straightforward.

In many cases, you'll be asked for at least 6 months of financial statements to support your application – so you'll need to do a little preparation before applying.

There are two main ways to go about securing a mortgage. Going directly, or through a broker.

- Go direct – Do your own research and apply directly to lenders yourself. While this option may seem like a good idea, if you're applying for a mortgage in Ireland while living abroad you could find yourself spending a lot of time trying to find the right lender. Since many lenders won't lend to outside buyers, your options will be limited. If you do find a high street lender willing to work with you, you may find yourself facing various disadvantages, such as:

- Reduced market access

- Sole responsibility for ensuring your application is made correctly.

- You may spend a lot of time chasing things up.

- You could end up with a mortgage which later becomes unaffordable, with no right to claim compensation.

- You may fall foul of fees and penalties long after taking out the mortgage.

- Apply through a broker (recommended) – An experienced whole-of-market mortgage broker, like the ones we work with, will help you secure a mortgage by connecting you with the right lender first time. They will help you with the entire process, from initial application all the way through getting approval and reaching completion. As a foreigner applying for a mortgage in Ireland, you'll find several advantages in applying through a specialised mortgage broker, such as:

- If you're applying for a mortgage in Ireland while living outside of the country, using a mortgage broker can help make the process far easier for you. Not all lenders will lend to people outside Ireland and a broker will save you time and trouble by matching you with the right lender first time around.

- An experienced mortgage broker will understand all the necessary criteria requirements for mortgage approval in Ireland. They will save you a lot of time and hassle by knowing which lenders will be willing to consider your application based on the criteria you meet.

- Better market access – a whole of market broker can find you the right mortgage at the best possible price, and make sure you're getting the right mortgage for your circumstances.

- Help with the red tape – a broker can help with your Ireland mortgage application and ensure you meet the lender's criteria, giving you peace of mind that you're more likely to get approval for the mortgage you want, saving you time, hassle and potential headaches.

- Mortgage brokers have a duty of care – this means they must recommend an appropriate product and justify what makes the mortgage they recommend right for you. If the advice you receive is flawed, you can complain and may be compensated.

Make an enquiry to speak to a broker experienced in mortgages in Ireland.

They will be able to answer all your questions and help you find the right mortgage at the most competitive price, based on your circumstances. The service is free, there's no obligation and there's no marks on your credit report.

How much of a mortgage can I get?

While the process of securing a mortgage in Ireland can be straightforward, you should be prepared for the large number of checks they might make to ensure you're able to afford the loan.

The amount you will be able to borrow on a mortgage in Ireland will depend on a lender assessing the following factors when considering your application:

- Your income, and how you earn it.

- Your outgoings and expenses.

- Your credit history – A lender will perform a mortgage credit check.

- Your age.

- Your savings and existing assets.

- Your loan to value and the value of the house itself.

- Whether you're borrowing on your own, or jointly, and if you can get a guarantor or not.

Mortgage document requirements for foreigners buying property in Ireland

You'll need to get your documents in order before applying for a mortgage.

Most mortgage lenders will require you to provide evidence that you can meet your mortgage payments comfortably.

You will need to provide paperwork of at least 6 months banking history, with complete detailed evidence of your income, for a mortgage this may be through payslips and provide details of your outgoings. They will use this to check your income is legitimately sourced and high enough to meet repayments as part of the mortgage approval process.

An experienced mortgage broker, specialising in mortgages in Ireland will be able to tell you exactly which lenders will accept the evidence you can provide to support your application. The lending criteria for foreigners buying in Ireland is strict and only a limited number of lenders offer mortgages under the circumstances.

To ensure you get the best mortgage possible, make a quick enquiry and we'll match you with a broker with the right experience to help you get the mortgage you want.

We're so confident in our service, we

guarantee

it.

We know It's important for you have complete confidence in our service, and trust that you're getting the best chance of mortgage approval. We guarantee to get your mortgage approved where others can't - or we'll give you £100*

Can I get a mortgage for a holiday home in Ireland?

If you're interested in getting a mortgage for a second home in Ireland, or to buy a holiday home in Ireland, depending on your circumstances, you should be able to find lenders willing to help with this.

In general, overseas investors are able to buy property in Ireland. Even individuals requiring visas to travel to Ireland are able to purchase property.

If you need a mortgage for a holiday home or second home, this should be achievable, but most lenders will want to see a healthy deposit and, as with other mortgages in Ireland, you should also be prepared for stringent affordability and criteria checks.

How to get a second home mortgage in Ireland

When you're looking for a mortgage for a second home abroad, you have two options.

- Get a mortgage from the country where you want to buy – This is possible but you may find it more difficult to prove your credit-worthiness and find the paperwork involved quite onerous. Because of the lending restrictions the Irish government have in place to protect the economy, you may find you require more of a deposit than is desirable.

- Get an overseas mortgage from a lender in the UK – This is likely to be the more straightforward option for you and you may find you're able to execute things sooner due to a UK lender's ease of performing eligibility checks electronically.

Although the Irish economy is recovering, the continuing economic uncertainty may limit your options when it comes to finding an Irish mortgage provider for your second home.

If you wish to discuss your options and get an idea of more precise costings that might apply, talk to one of the expert brokers we work with.

Remortgaging in Ireland

If you want to remortgage your house in Ireland, you'll find several remortgage options available from mortgage providers.

If you want to keep your home but switch away from you current mortgage lender, you may be able to save money by entering an agreement with a better rate. If, at the same time, you wanted to arrange to borrow more money to put towards home improvements or to help your children to buy their first home, then that might also be a possibility for you.

Before you make any decisions when it comes to remortgaging or switching away from your current mortgage arrangement, you should check to make sure you won't be subject to any early repayment charges, fees or penalties.

Your best bet when you're looking for the best available remortgage deals in Ireland is to use a whole-of-market broker, like the ones we work with.

Call 0808 189 2301 or make an enquiry and we'll match you with a mortgage broker for a free, no-obligation chat about a remortgage in Ireland.

How easy is it to change mortgage provider in Ireland?

If you have equity in your home, can show that you can afford to repay your mortgage and are of the right age, you should have little difficulty changing mortgage provider in Ireland.

As mentioned above, the first thing to do is check that your current mortgage lender won't apply an early repayment charge or other expensive fees or penalties, effectively making a change of lender less viable due to unexpected costs.

Reasons to switch mortgages include to save money, or borrow more at a better rate than you can achieve with your current lender.

In fact, the number of borrowers deciding to switch mortgages in Ireland has increased in the last few years.

This may be down to the fact that many banks and lenders will entice homeowners looking to remortgage with cashback incentives. This can include actual cash handouts, assistance with costs and fees, or offering a percentage of the whole mortgage as a cash sum.

How to switch mortgages

First things first, check that switching your mortgage in Ireland is going to save you money. If it's not then remortgaging may be futile, unless you're looking to borrow more money and your current lender is making life difficult.

The best way to see if you might be able to save money by remortgaging is to talk to a whole-of-market broker, like the ones we work with, and ask them what deals may be available to you.

They'll be able to take an overview of your circumstances and gather comparisons from a variety of different lenders so you have a choice of remortgage options and can work out exactly how much money you could save over months and, potentially, years.

Seven steps to switching your mortgage in Ireland

Not sure how to remortgage your property? Follow our easy steps below.

- Ensure you're switching to a lender offering better value – Some of the best rates are available to people who want to borrow less than 70%, so the lower the loan-to-value, the better the rates you should find.

- Make sure the bank you want to switch to has criteria you can meet – Most banks will be unlikely to accept a remortgage application if you're in arrears on your current mortgage or you have negative equity. It's also important that you can prove you can afford to repay the money you want to borrow.

- Have your documents in order – As well as your proof of ID and address details, you'll need to have your payslips, P60, bank statements for the last 6 months and your mortgage account statements.

- Complete the mortgage switcher application form – That you'll receive from the provider you're moving to.

- Find and engage the services of a solicitor – To look after the required legal work.

- Get an independent valuation – Your new mortgage provider will need an up-to-date valuation of your property on which to base their lending decision.

- Make sure your home insurance and mortgage protection insurance – Are set up to cover your new mortgage loan.

How to get the best mortgage switch rates

When it comes to getting the best rates on your remortgage or mortgage switch, you can save yourself a whole lot of time and effort by talking to a whole-of-market mortgage broker, like the ones we work with.

A whole-of-market broker has access to all the mortgage lenders in both the UK and Ireland and can help you to gather comparisons from different mortgage lenders, ensuring you're getting the best deal available for your own unique circumstances.

Call 0808 189 2301 or make an enquiry to find out how much you could save by switching mortgages today.

How to get a mortgage with bad credit

Take a look at our detailed information pages on bad credit mortgages which explains in detail how you can still get a mortgage even if you have bad credit.

A broker with expert knowledge in bad credit mortgages in Ireland will be able to answer all your questions and help you find a lender with the right mortgage for you.

Did you know… An Online Mortgage Advisor broker has access to more deals than any comparison site. Get Started to unlock more options and increase your chance of mortgage approval.

Rated Excellent by our customers

Getting a mortgage after bankruptcy in Ireland

Once you've been discharged from bankruptcy in Ireland you're allowed to get credit from financial institutions, mortgage lenders included.

However, your bankruptcy will have had a major negative impact on your credit rating so the number of mortgage lenders willing to risk lending to you will be significantly reduced.

The decision on whether to lend to someone who has previously been bankrupt is up to individual lenders.

The expert advisors we work with are whole-of-market brokers with access to all mortgage lenders. They know which mortgage lenders will lend to people with adverse credit histories and understand the difficulties you may face when you want to get on, or return to, the property ladder.

If you have been bankrupt, mortgage lenders who are willing to lend to you will want to protect their risk so you may find that most lenders will want you to provide a higher deposit and will also charge higher interest rates on the loan.

Call 0808 189 2301 or make a quick online enquiry to find out what sort of mortgage terms you could achieve based on your own set of circumstances.

The service we offer is free and there's no obligation.

Why use a mortgage broker if you have bad credit?

As explained above, if you have bad credit and are seeking a mortgage, the number of lenders willing to take a risk on you will be significantly reduced.

As well as this drawback, you're also likely to be faced with needing a far higher deposit than you might otherwise and be charged higher rates of interest too.

While all this sounds like a lot of negativity to overcome, it doesn't have to mean that a mortgage is out of range for you.

The right mortgage broker who understands the circumstances around your bad credit, whichever form it takes, can work with you to find a lender willing to offer you a mortgage.

The brokers we work with are all whole-of-market and have access to the entire range of mortgage lenders available to every kind of borrower.

Call 0808 189 2301 or make a no-obligation enquiry to find out the kind of mortgage deal they could help you to secure.

The service we offer is free, there's absolutely no obligation and it won't leave a mark on your credit rating.

Consequences of defaulting on your mortgage

Your credit report will be negatively affected and your mortgage lender could take you to court. In the worst case scenario, this could mean your property is repossessed.

If you're struggling to keep up your mortgage payments, the first thing you should do is speak to your lender. Once they know about your difficulties they must take certain steps to help deal with your problem. Certainly, repossessing your home should be an absolute last resort.

If you've already exhausted all your options and your home is being repossessed, this will take time to proceed through the legal steps and you may have time to take steps to avoid losing your home altogether.

If at all possible, and you don't have negative equity on your property, you should try to sell your home for the best price possible and repay your mortgage in full.

You would, of course, need to find somewhere new to live, but that would also be true if your mortgage lender was to repossess your home.

You can read more information and understand much more of what you might expect on the Irish Citizens Information website.

If you would like to speak to an expert about options you may have, make an enquiry. We'll match you with one of the expert brokers we work with. They will be happy to answer all your questions and talk through what possibilities may be open to you.

Subprime mortgage lenders in Ireland

There are several mortgage lenders in Ireland who deal in subprime mortgages, with a handful of foreign lenders, including German and British banks, who have extended their subprime mortgage offers to borrowers in Ireland.

Some of these lenders will require borrowers to have a guarantor to offset the risk the lender is making, while others simply have high deposit requirements and charge high rates of interest.

Because subprime mortgage lenders in Ireland can't be found on the high street, you need a whole-of-market mortgage broker to source the right deal. To find a subprime mortgage which might be right for your circumstances, talk to one of the advisors we work with.

We'll match you with an expert in subprime mortgages who will be able to answer your questions and compare mortgages which might suit your needs.

Call 0808 189 2301 or make a no-obligation online enquiry.

Did you know… An Online Mortgage Advisor broker has access to more deals than any comparison site. Get Started to unlock more options and increase your chance of mortgage approval.

Speak to a mortgages in Ireland expert

Buy-to-let mortgages in Ireland

While many lenders in Ireland offer buy-to-let mortgages to borrowers, as a general rule, buy-to-let mortgages in Ireland are harder to get than residential mortgages.

For example, many lenders will typically offer a lower loan to value (LTV) rate than they would for a residential property, and they may also set stricter limits on the maximum value of the property.

As with regular residential mortgages, you can choose between interest-only and repayment – and a range of term lengths. You may find that there are fewer choices than on the conventional mortgage market.

While some lenders will assess how much they will lend you based on more than just the rental income the property will generate, most will consider lending 70% to 75% of the property value so you'd need to have at least 25% deposit upfront, and preferably 30% to maximise the number of potential lenders to choose from.

I'm a non-resident. Can I get a buy-to-let mortgage in Ireland?

You don't need to be an Irish citizen to get a buy-to-let mortgage in Ireland. There is, in fact, a specific agreement in place to make property ownership that little bit easier for UK nationals in Ireland.

However, non-Irish and non-UK nationals are likely to face more hurdles and you may find it necessary to set up an Irish-registered company to invest through. Though this isn't always essential.

There are a couple of the areas you should be aware of when considering a buy-to-let mortgage in Ireland:

- Taxation – Tax laws in Ireland can complicate things for non-resident landlords. For example, tenants are supposed to deduct tax from their rental payments to non-resident landlords. When investing abroad, there may be two sets of tax laws to bear in mind. If you're serious about buying in Ireland, taking advice from an expert advisor could save you a lot of time, money and hassle later. The services of a local accountant, estate agent and lawyer could also pay dividends later.

- Stricter eligibility requirements and stress tests – Foreign borrowers may be subject to stricter stress tests, so the figures on your property investment will really need to stack up. Despite the additional checks and tax laws, if you're not resident in Ireland you should still be able to find a mortgage lender willing to lend to you for a buy-to-let in Ireland. However, if you are earning your income in a currency other than the euro, some banks won't consider your application for a mortgage at all. A few lenders will consider mortgage applicants on a case-by case basis , while others will consider applications from investors no matter where in the world they live.

Self-build mortgages in Ireland

If you own land in Ireland and want to build your own home, the land you own will act as your deposit for your self-build mortgage.

Some lenders may offer up to 100% of the build costs if the expected value of your completed home doesn't exceed 80%.

If you need to buy the land you wish to build on then you should be able to get a mortgage for 90% of the value for the total site and costs of construction. The structure of deals like this can be complex and the funds for the build itself are often paid in stages, and also in arrears.

When you apply for a self-build mortgage in Ireland, your application is assessed in the same way a traditional mortgage would be assessed, but there are a few additional steps on the way:

- For your mortgage loan, you'll need to show that you've secured complete and final planning approval (Grant of Permission).

- You'll need to submit a detailed breakdown of costs, drawn up by a qualified architect or engineer. Make sure whoever you're using has professional indemnity insurance in place.

- State, whether the costings presented, are an estimate or an actual contract price. Since overruns can and do happen for a number of reasons, if the quote is an estimate your lender would need to factor the risks in with a contingency, which will reflect the rate you may be offered on your self-build mortgage.

- Do your research. Know what all your outlays are going to be: fees, council levies, utility connection fees etc.

- Once the mortgage terms are agreed, the loan will be paid in stages. At each stage, your appointed design professional must sign off to say they're complying with building regulations before payment can be issued.

If you have land in Ireland, or have found land you want to build on and are looking for a self-build mortgage, talk to one of the advisors we work with. All the brokers we work with are whole-of-market and have a wealth of experience of arranging mortgages for customers in all sorts of circumstances.

Commercial mortgages in Ireland

Commercial mortgages in Ireland aren't too dissimilar from commercial mortgages in the rest of the world. You could use one to purchase premises for your business (anything from a shop front to a textile mill).

Commercial buy-to-let is a huge and specialist category and, as such, we can only really provide an outline of it here.

The kind of property you want to buy may affect the kind of lender you go with. Due to the huge range of property types in commercial mortgage finance, certain lenders specialise in certain sectors.

After all, the kind of funding you need for a coffee shop is very different to the kind of funding you'd need for a factory, or the bridging finance or development finance that you might need on a new build.

How to apply for a commercial mortgage

The application process will vary, depending on the lender, your business sector, the property in question and the structure in which your business and application are structured.

But, as a general rule, applications for commercial mortgages can be more complex than residential mortgages and tend to come with more hoops to jump through.

These can include:

- A detailed business plan – along a background to all the applicants (or 'promoters'), along with details on the property in question.

- Financial projections – including the ability to service the debt revenue forecasts, and your recent company performance.

- Your business accounts and bank statements, including a list of your debtors and creditors.

- An independent valuation of the property.

- Legal advice, especially the lender requires you to personally guarantee the mortgage.

Larger loan amounts and larger minimums

The scale of commercial mortgages is often much higher than that of residential mortgages.

As such, you can expect minimum and maximums on loan sizes to be larger – loans exceeding €10,000,000 are not unheard of in the commercial mortgage space.

Like residential mortgages, you can typically choose from range of terms and LTVs, though if the kind of project that you're looking to finance is particularly niche or expensive, you may have less choice in this area.

Get in touch and talk to one of the expert brokers we work with. We'll match you with a broker who is experienced in arranging commercial mortgages in Ireland.

Non-resident mortgages in Ireland

Irish banks tend to look at non-residents as investors, regardless of what you plan to do with the property.

As such, you're likely to find:

- You'll get a lower LTV – this means that the rates you're offered are likely to be less competitive, and you may have to jump through more hoops to get them. Typically, as a non-resident borrower, the maximum you might be able to borrow would be 65% LTV, so you will need at least 35% deposit. Sometimes this can rise as high as 40% since some lenders will also want to see the first 6 months of mortgage payments available and already sitting in your bank account.

- You may get a better rate if you decide to move into your property later – this may mean that if you later move to Ireland to occupy your property, your lender may offer you a better (or standard residential) rate. If you're Irish and have been living abroad, you may be wise to purchase a property ahead of your return to Ireland since if you wait until you are back in Ireland, you may have to wait a year before the banks will consider lending to you.

- You don't have to be a citizen of Ireland to get a residential mortgage – but, as a general rule, the process will be easier for you if you're based in a Eurozone country. Not all Irish banks are comfortable dealing with non-nationals – expats are typically seen as more of a risk.

- The currency you're paid in is important – As a result of an EU regulation known as the mortgage credit directive, many lenders won't consider you unless you make your income in Euros. That said, those lenders who will consider lending to you may want you to put down a larger deposit to offset the risk. They may also apply a 'haircut' to your income, for example, stress-testing against your annual income falling by 20% in case of currency fluctuations.

- Administrative hassle – If you're looking for a mortgage to buy a home ahead of moving back to live in Ireland, you may find it difficult to pay fees and other associated costs without an established Irish bank account. Also, if savings you have ready for property purchase aren't already in euros, you should check how much you'll be charged for an international money transaction.

- You may struggle as a first-time buyer – if you don't already own property elsewhere in the world or have previously owned a property, many lenders won't consider you for a non-resident mortgage in Ireland.

- Permanent employment is helpful – most lenders will want to know that you have permanent employment ahead of lending to you.

So if you are looking for a mortgage when you're self-employed or trying to get a mortgage as a contractor and are looking for a mortgage in Ireland as a non-resident, you may find it trickier to get a lender willing to consider your mortgage application.

Where can I find a mortgage calculator for Ireland so I can work out how much I can borrow?

The Competition and Consumer Protection Commission (CCPC) has an online mortgage calculator for Ireland. Always remember though that this kind of online calculator can only provide a very rough outline of what you may be able to borrow.

It can't take your unique circumstances into account and certainly won't base projections on figures from more than a handful of well-known lenders.

For a clearer idea of exactly what mortgage you could get in Ireland, along with the costs involved, get in touch on 0808 189 2301.

We'll match you with one of the whole-of-market experts we work with who can take a look at your circumstances to give you a much clearer idea of what might be possible for you.

How can I get the best mortgage rates in Ireland?

Sadly, there isn't a simple answer to this question.

Whilst there are some certain factors that can help you get a better rate, such as a larger deposit and cleaner credit, every lender tends to have their own criteria, and these criteria can change over time.

However, as a rule of thumb, the following steps will help you to get a better rate.

- Reduce your costs – mortgage lenders will look at your fixed expenses as part of their stress tests. One way to make a better impression is to lower these expenses in the months leading up to your application. For example, cancel that unused gym membership, forego that expensive holiday or finish paying off that high interest car loan. If you're applying for a mortgage with a loan it may be seen as a liability in the context of a possible mortgage. If you can pay them down, or pay them off you'll be putting yourself in a far stronger position.

- Increase your deposit – lenders will view you as presenting less risk if you need to borrow less as a percentage of the total property price (i.e. the lower your LTV). The less of a risk you are perceived to be, the better the rate they'll offer.

- Clean up your credit – your credit history has a big impact on how much you're able to borrow so if you know there are issues, do what you can to improve matters and take the time to contact creditors if you wish to dispute a record they have made in error.

- If you're employed, increase your income – if you're in employment, you could consider waiting for your annual review (and possible raise) before making your application

- If you're self employed, get your accounts in order – if you're self-employed, it's likely that you'll need to show at least a year's worth of healthy accounts. The aim is to show that you or your business is doing well enough to pay the mortgage.

If you can do any of the above you'll stand yourself in good stead to get a more competitive rate on your mortgage. To make sure you really are getting the best available deal, speak to a broker experienced with mortgages in Ireland.

Where can I find a mortgage comparison for Ireland?

The Competition and Consumer Protection Commission (CCPC) has a mortgage comparison tool allowing you to compare mortgages available in Ireland.

However, this tool will only give you a comparison of the best-known mortgage lenders in Ireland and doesn't take your own circumstances into account.

The best way to compare mortgages in Ireland is use a whole-of-market broker, like the ones we work with.

An expert, whole-of-market broker can provide a market-wide comparison that includes broker-only deals which are unavailable on the high street. They'll look at your financial picture, your needs and circumstances and search all the available mortgage lenders to find you the absolute best deal for you,

The right broker knows how much money the right mortgage decision could potentially save you and will work to make sure they get the best possible price on the mortgage you need for the property you want.

Speak to an expert broker about mortgages in Ireland

Whether you're looking for a mortgage in Ireland after living abroad for several years, are interested in investor mortgages in Ireland due to business expansion or as a buy-to-let mortgage, get in touch.

We'll match you with one of the expert brokers we work with ensuring they have the right knowledge and expertise to find you the best deal available. They will answer all your questions and expertly guide you through all the necessary steps of securing a mortgage in Ireland from overseas.

Call 0808 189 2301 or make a quick online enquiry.

The service we offer is free and there's no obligation.

Related Articles

Continue Reading

*Based on our research, the content contained in this article is accurate as of the most recent time of writing. Lender criteria and policies change regularly so speak to one of the advisors we work with to confirm the most accurate up to date information. The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. All advisors working with us are fully qualified to provide mortgage advice and work only for firms who are authorised and regulated by the Financial Conduct Authority. They will offer any advice specific to you and your needs.

Some types of buy to let mortgages are not regulated by the FCA. Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage. Equity released from your home will also be secured against it.

constantanium1957.blogspot.com

Source: https://www.onlinemortgageadvisor.co.uk/overseas-mortgages/mortgages-in-ireland/

0 Response to "Holiday Home Finance Ireland"

Post a Comment